- Learn

- Types of Dividends: A Complete Guide for Investors

Types of Dividends: A Complete Guide for Investors

Dividends represent one of the most attractive aspects of investing in stocks, providing shareholders with a tangible return on their investment. Understanding the various types of dividends is crucial for making informed investment decisions and maximizing your portfolio's potential. This comprehensive guide explores the different dividend types, their characteristics, and how they impact both companies and investors.

Table of contents

What Are Dividends and Why Do They Matter?

Dividends are payments made by corporations to their shareholders as a distribution of profits. These payments serve as a reward for investors who have committed their capital to the company. When a company generates profit, management faces several options: reinvest the earnings back into the business, pay down debt, or distribute a portion to shareholders through dividends.

The decision to pay dividends reflects a company's financial health, management philosophy, and growth strategy. Mature companies with stable cash flows often prefer dividend payments, while growth companies typically reinvest profits to fuel expansion.

The Importance of Dividend Types in Investment Strategy

Different dividend types serve various purposes and appeal to different investor profiles. Conservative investors might prefer predictable cash dividends, while growth-oriented investors might appreciate stock dividends that compound their holdings over time. Understanding these distinctions helps investors align their dividend expectations with their financial goals.

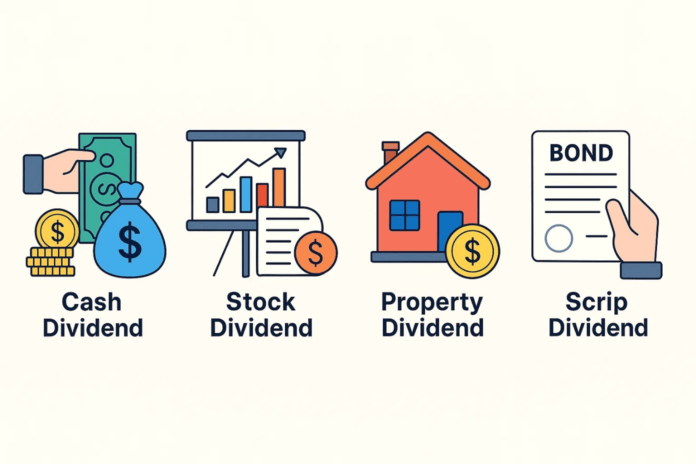

Core Types of Dividends Every Investor Should Know

How Cash Dividends Work

Cash dividends represent the most straightforward and popular form of dividend payment. When a company declares a cash dividend, it commits to paying a specific amount of money per share to all eligible shareholders. These payments typically occur quarterly, though some companies opt for annual or semi-annual distributions.

Calculating Your Cash Dividend Returns

The calculation is simple: multiply the dividend per share by the number of shares you own. For example, if a company declares a $2.50 dividend per share and you own 200 shares, your dividend payment would be $500.

Tax Implications of Cash Dividends

Cash dividends are generally taxable in the year they're received. In the United States, qualified dividends receive favorable tax treatment, often taxed at capital gains rates rather than ordinary income rates. This tax advantage makes dividend-paying stocks particularly attractive for investors in higher tax brackets.

Stock Dividends: Growing Your Shareholding

Understanding Stock Dividend Mechanics

Stock dividends involve distributing additional shares to existing shareholders instead of cash. This approach allows companies to reward shareholders while preserving cash for business operations. When you receive a stock dividend, your total number of shares increases, but the per-share price typically decreases proportionally.

Benefits and Drawbacks of Stock Dividends

Stock dividends offer several advantages: they're typically not taxable until you sell the shares, they increase your ownership percentage, and they can benefit from compound growth over time. However, they don't provide immediate cash flow and may dilute the stock price in the short term.

Real-World Example of Stock Dividends

Consider a company trading at $100 per share that declares a 10% stock dividend. If you own 100 shares worth $10,000, you'd receive 10 additional shares. Your total holding would become 110 shares, but the stock price would likely adjust to approximately $90.91 per share, maintaining your total investment value.

Special Dividends: Unexpected Windfalls

What Triggers Special Dividend Payments

Special dividends are one-time payments that occur outside regular dividend schedules. These extraordinary distributions often result from exceptional circumstances such as asset sales, successful acquisitions, legal settlements, or exceptionally profitable years.

Impact on Stock Prices

Special dividends can significantly impact stock prices, often causing volatility around announcement and payment dates. The stock price typically adjusts downward by the dividend amount on the ex-dividend date, reflecting the value distributed to shareholders.

Famous Special Dividend Examples

Microsoft's $32 billion special dividend in 2004 remains one of the largest in corporate history. More recently, many companies issued special dividends in 2017 following U.S. tax reform, taking advantage of favorable repatriation rates for overseas cash.

Advanced Dividend Types for Sophisticated Investors

Preferred Dividends: Priority Income Streams

Characteristics of Preferred Stock Dividends

Preferred dividends offer several advantages over common stock dividends. They typically feature fixed payment amounts, priority over common dividends, and greater predictability. Preferred shareholders receive their dividends before any payments to common shareholders, making these investments more secure during financial difficulties.

Types of Preferred Stock Features

Preferred stocks can include various features that affect dividend payments:

Cumulative preferred: Missed dividends accumulate and must be paid before common dividends

Non-cumulative preferred: Missed dividends don't accumulate

Participating preferred: May receive additional dividends beyond the fixed rate

Convertible preferred: Can be converted to common stock under certain conditions

Evaluating Preferred Stock Investments

When considering preferred stocks, investors should examine the dividend yield, credit quality of the issuer, call provisions, and any conversion features. These factors significantly impact the investment's risk and return profile.

Cumulative Dividends: Guaranteed Future Payments

How Cumulative Dividends Protect Investors

Cumulative dividends provide important protection for preferred shareholders. If a company suspends dividend payments due to financial difficulties, these missed payments accumulate as "dividends in arrears." The company must pay all accumulated dividends before resuming payments to common shareholders.

Calculating Dividend Arrears

Dividend arrears accumulate based on the stated dividend rate. For example, if a preferred stock has a 6% annual dividend rate and misses payments for two years, the company owes 12% of the stock's par value before any common dividends can be paid.

Investment Implications

Cumulative dividends make preferred stocks more attractive during uncertain economic periods. However, companies in severe financial distress may struggle to pay accumulated dividends, potentially leading to years without income.

Liquidating Dividends: Final Distributions

Understanding Liquidation Scenarios

Liquidating dividends occur when companies wind down operations and distribute remaining assets to shareholders. These payments represent a return of capital rather than traditional profit distributions, affecting their tax treatment and investment implications.

Priority in Liquidation Proceedings

During liquidation, payment priorities follow a specific order: creditors receive payment first, followed by preferred shareholders, and finally common shareholders. This hierarchy significantly impacts the amount individual investors might receive.

Tax Considerations for Liquidating Dividends

Liquidating dividends often qualify as return of capital, reducing the investor's cost basis in the stock. This treatment can be more favorable than ordinary dividend taxation, though investors should consult tax professionals for specific guidance.

Specialized Dividend Structures

Property Dividends: Non-Cash Distributions

When Companies Choose Property Dividends

Property dividends involve distributing assets other than cash or stock to shareholders. Companies might choose this approach when they have excess inventory, real estate, or other assets that can benefit shareholders while improving the company's balance sheet.

Valuation Challenges

Property dividends present unique valuation challenges. Companies must determine fair market value for distributed assets, while shareholders must assess whether to retain or sell received property. These complications make property dividends relatively rare in modern markets.

Tax Implications for Recipients

Recipients of property dividends typically must report the fair market value as dividend income. This creates potential tax obligations even if the shareholder chooses to retain the property rather than sell it immediately.

Scrip Dividends: Flexible Payment Options

Understanding Scrip Dividend Mechanics

Scrip dividends offer shareholders choices in how they receive dividend payments. Typically, investors can choose between cash payments or additional shares, providing flexibility based on individual preferences and tax situations.

Benefits for Companies and Shareholders

Companies benefit from scrip dividends by preserving cash while still rewarding shareholders. Investors appreciate the flexibility to choose their preferred form of payment based on current financial needs and tax considerations.

Strategic Considerations for Dividend Investors

Dividend Reinvestment Plans (DRIPs)

Maximizing Compound Growth

Dividend reinvestment plans allow investors to automatically reinvest dividend payments into additional shares. This strategy can significantly boost long-term returns through compound growth, especially in consistently dividend-paying companies.

Cost Advantages of DRIPs

Many companies offer DRIPs with reduced or eliminated fees, making them cost-effective ways to build positions over time. Some plans even offer shares at slight discounts to market price, providing additional value.

Tax-Efficient Dividend Strategies

Qualified vs. Non-Qualified Dividends

Understanding the distinction between qualified and non-qualified dividends is crucial for tax planning. Qualified dividends receive favorable tax treatment, while non-qualified dividends are taxed as ordinary income.

Timing Considerations

Strategic timing of dividend-related transactions can optimize tax outcomes. Holding periods, ex-dividend dates, and year-end planning all influence the tax efficiency of dividend-focused strategies.

Building a Dividend-Focused Portfolio

Diversification Across Dividend Types

Balancing Risk and Income

Successful dividend investing requires balancing different dividend types to optimize risk and return. Combining high-yield common stocks, stable preferred shares, and growth-oriented companies creates a well-rounded dividend portfolio.

Sector Considerations

Different sectors tend to favor specific dividend types. Utilities often provide steady cash dividends, REITs offer high yields, while technology companies might prefer stock dividends or special distributions.

Monitoring Dividend Health

Key Metrics for Dividend Sustainability

Investors should monitor payout ratios, free cash flow, and earnings stability to assess dividend sustainability. Companies with payout ratios above 80% may face pressure during economic downturns.

Warning Signs of Dividend Cuts

Declining revenues, increasing debt levels, and industry headwinds often precede dividend cuts. Vigilant monitoring helps investors identify potential problems before they impact returns.

Conclusion: Maximizing Your Dividend Investment Strategy

Understanding the various types of dividends empowers investors to make informed decisions aligned with their financial goals. Whether seeking steady income through cash dividends, growth through stock dividends, or security through preferred dividends, each type offers unique advantages and considerations.

Successful dividend investing requires ongoing education, careful analysis, and strategic portfolio construction. By understanding these different dividend types and their implications, investors can build portfolios that provide both current income and long-term growth potential.

The key to dividend success lies in matching dividend types to your investment objectives, risk tolerance, and tax situation. As markets evolve and companies adapt their capital allocation strategies, staying informed about dividend trends and opportunities remains essential for investment success.

No comments yet

Be the first to share your thoughts on this article