- 📈 Market

- Stocks

- Bank of America Corp

- Vestor prediction

Bank of America Corp (BAC) Stock Forecast – Predictions & Technical Analysis 21.10.2025

Softline stock forecast for October 2025

Current Market Position and Price Dynamics

BankAmerica stock is currently trading at $0.52, positioning itself above key support levels in the market. This price point represents a strategic position for both short-term traders and long-term investors looking to capitalize on the banking sector's movements.

The most recent trading session opened at $0.51, with prices fluctuating between a high of $0.52 and a low of $0.50. This moderate volatility indicates sustained trader interest without excessive speculation, suggesting a relatively stable trading environment for BAC shares.

Price Movement Context

When evaluating BAC's current position, it's essential to consider its 52-week trading range. The stock has moved between $0.38 (low) and $0.56 (high) over the past year, placing its current valuation closer to the upper portion of this range. This positioning suggests relatively strong market confidence compared to its recent historical performance.

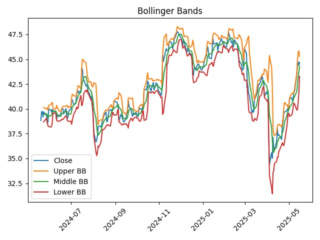

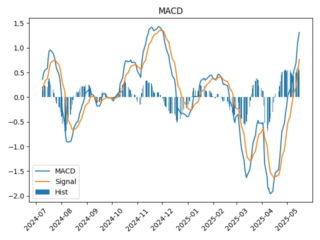

Technical Analysis Deep Dive

Technical indicators provide crucial insights into BAC's price momentum and potential future movements. By examining various metrics, investors can make more informed decisions about optimal entry and exit points.

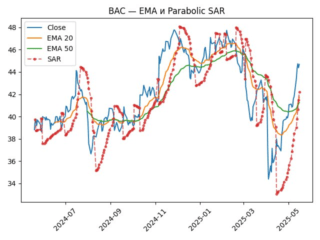

Moving Averages Analysis

Moving averages are fundamental tools for understanding price trends by smoothing out short-term fluctuations. BAC's current moving averages present an interesting picture:

Simple Moving Average (SMA) 50: $0.47

Simple Moving Average (SMA) 200: $0.49

Exponential Moving Average (EMA) 20: $0.48

Exponential Moving Average (EMA) 50: $0.48

The current price of $0.52 trading above all major moving averages signals bullish momentum. Particularly noteworthy is the position above the SMA 200, often considered a key benchmark for long-term trends. This configuration suggests that BAC may continue its upward trajectory in the near term.

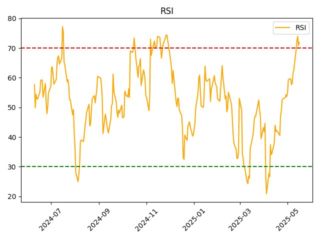

Momentum Indicators Assessment

Beyond moving averages, momentum indicators provide additional context about the strength and sustainability of the current price trend:

Parabolic SAR: $0.49 — confirms the current uptrend

Relative Strength Index (RSI): 71.93 — approaching overbought territory

Average True Range (ATR): $0.014 — indicates current volatility levels

Commodity Channel Index (CCI): 129.63 — suggests potential overbought conditions

Average Directional Index (ADX): 24.53 — confirms trend strength

On-Balance Volume (OBV): 113,447,502 — reflects healthy volume behavior

The RSI reading of 71.93 warrants particular attention as it approaches the traditional overbought threshold of 75. However, in strong uptrends, RSI can remain in overbought territory for extended periods. Combined with the ADX reading of 24.53 (above 20), this suggests the current trend has significant strength despite approaching overbought conditions.

Candlestick Patterns and Price Action

Recent trading sessions have revealed meaningful candlestick formations that experienced traders recognize as significant signals for future price movement. Most notably, an Engulfing pattern has been identified in recent price action.

The Engulfing pattern, particularly when appearing after a prolonged trend, often signals a potential reversal or strong continuation depending on its context. In BAC's current scenario, this pattern appearing during an uptrend could suggest sustained bullish sentiment if supported by increasing volume.

Support and Resistance Levels

Based on technical analysis, several critical price levels deserve special attention:

Primary Resistance: $0.56 (52-week high)

Secondary Resistance: $0.53 (recent swing high)

Primary Support: $0.48 (EMA 20)

Secondary Support: $0.47 (SMA 50)

These levels will likely influence short-term price action and could serve as potential entry or exit points for active traders.

Fundamental Analysis Overview

While technical indicators provide insights into market sentiment and price momentum, fundamental analysis reveals the underlying financial health of BankAmerica, offering a more complete picture for investment decisions.

Key Financial Metrics

Price-to-Earnings Ratio (P/E): 13.34

Return on Equity (ROE): 9.46%

Return on Assets (ROA): 0.84%

Debt-to-Equity Ratio: 2.62

Market Capitalization: $3.89 billion

The P/E ratio of 13.34 positions BAC as reasonably valued compared to the banking sector average, suggesting neither significant overvaluation nor undervaluation at current levels. The ROE of 9.46% indicates decent profitability and efficient use of shareholder equity, though slightly below the industry average for top-tier banks.

Dividend Analysis

For income-focused investors, BAC's dividend profile offers compelling considerations:

Dividend per Share: $0.003

Dividend Yield: 0.61%

Ex-Dividend Date: June 5, 2025

Payment Date: June 27, 2025

While the 0.61% yield may appear modest compared to some banking peers, BAC's dividend history shows consistency and potential for future growth as financial conditions improve.

Risk Assessment and Market Sentiment

Every investment carries inherent risks, and BAC is no exception. Current market assessment suggests a neutral stance—certain parameters appear attractive, but potential risks remain that investors should carefully consider.

Potential Risk Factors

Interest Rate Sensitivity: As a banking institution, BAC remains particularly vulnerable to Federal Reserve policy changes and interest rate fluctuations

Regulatory Environment: Potential changes in banking regulations under current administrative policies

Credit Quality Concerns: Economic slowdowns could impact loan performance

Market Competition: Increasing pressure from fintech disruptors and traditional banking rivals

Positive Catalysts

Digital Banking Expansion: BAC's continued investments in financial technology infrastructure

Operational Efficiency Improvements: Cost-cutting measures showing positive impacts on margins

Asset Quality Metrics: Maintaining strong loan portfolio performance

Capital Return Programs: Potential for increased dividends or share buybacks

Short-Term Price Forecast

Based on comprehensive technical analysis incorporating multiple indicators, the projected price for the next trading day stands at approximately $0.50. This forecast considers current momentum, volume patterns, and historical price behavior.

The prediction suggests a slight pullback from current levels, potentially representing a healthy consolidation before continued upward movement. Such consolidation phases often provide attractive entry points for investors looking to establish or increase positions.

Key Levels to Watch

Traders should pay particular attention to the $0.47 and $0.48 levels, which represent potential support zones where buying interest might emerge. These levels align with key moving averages that frequently act as dynamic support in uptrending markets.

Long-Term Investment Perspective

For investors with extended time horizons, BAC presents an interesting value proposition within the banking sector. The stock's technical configuration, combined with its fundamental metrics, suggests potential for sustainable growth over the medium to long term.

Growth Catalysts for Extended Timeframes

Interest Rate Normalization: Expected benefits from a potentially higher interest rate environment in coming years

Economic Recovery Effects: Banking sector tends to benefit from broader economic expansion cycles

Digital Transformation Initiatives: Long-term cost savings and market share growth from technology investments

Expansion of Wealth Management Services: Higher-margin business segments showing promising growth

Trading Strategies for Different Investor Profiles

Conservative Investor Approach

For risk-averse investors, considering BAC's current technical positioning and fundamentals, a gradual position-building strategy may be appropriate:

Dollar-Cost Averaging: Systematic investment at regular intervals

Dividend Reinvestment: Leveraging the dividend program for compounded returns

Protective Options Strategies: Using covered calls to generate additional income while holding the underlying stock

Growth-Oriented Investor Strategy

Investors prioritizing capital appreciation might consider:

Momentum-Based Entry: Buying on confirmed breakouts above key resistance levels

Technical Pullback Opportunities: Entering on retracements to key moving averages

Options Strategies: Using long calls to leverage potential upside movements with defined risk

Active Trader Approach

Short-term traders might benefit from:

Range Trading: Utilizing established support and resistance levels

Indicator-Based Entries: Trading RSI divergences and other technical signals

News-Driven Strategies: Positioning ahead of earnings announcements and Federal Reserve meetings

Sector Comparison and Relative Performance

Evaluating BAC's performance within the broader banking sector provides additional context for investment decisions. Compared to major competitors, BAC has shown moderate strength in recent months, outperforming some regional banking peers while slightly lagging behind some of the largest financial institutions.

This relative performance positioning suggests BAC represents a middle-ground option within the banking sector—offering more stability than smaller regional banks while potentially providing better value than some premium-priced larger institutions.

Technical-Fundamental Correlation Analysis

The most compelling investment cases often emerge when technical and fundamental signals align. In BAC's current situation, there are several noteworthy correlations:

Price Above Key Moving Averages: Coincides with improving operational metrics

Volume Patterns: Institutional accumulation appears to align with positive analyst sentiment

Technical Momentum: Corresponds with improving quarterly earnings expectations

This alignment between technical indicators and fundamental factors strengthens the overall investment thesis for BAC at current levels.

Conclusion and Summary Outlook

The forecast for BankAmerica (BAC) remains moderately optimistic based on comprehensive analysis of both technical indicators and fundamental metrics. With the stock trading above key moving averages and showing strong momentum indicators despite approaching overbought conditions, the technical picture appears favorable for continued strength.

From a fundamental perspective, reasonable valuation metrics, solid if unspectacular profitability ratios, and consistent dividend policies provide a stable foundation for investor confidence. The banking sector as a whole faces both challenges and opportunities in the current economic environment, positioning BAC as a relatively balanced option within the financial services industry.

For potential investors considering BAC, the current market environment with volatility of $0.014 (ATR) and trend strength of 24.53 (ADX) presents an interesting opportunity, particularly for those with medium to long-term investment horizons.

Predicted price

Historical return calculator

Income for the selected period

Total: -$60.48-0.40%

Calculation based on the dynamics of the share price for the period from 21.09.2025 to 21.10.2025

read other forecasts

No comments yet

Be the first to share your thoughts on this