Apple (AAPL) Stock Forecast – Predictions & Technical Analysis 21.10.2025

Apple stock forecast for October 2025

Current Stock Performance Overview

Apple stock currently trades at $2.35 (211.26 rubles), maintaining a position above key support levels. This positioning reflects investor confidence despite recent market fluctuations affecting the tech sector broadly. The stability exhibited by AAPL shares demonstrates the company's resilience in challenging economic conditions.

Today's trading session opened at $2.36 (212.36 rubles), reaching a high of $2.36 (212.57 rubles) and a low of $2.33 (209.77 rubles). This moderate volatility indicates balanced trading interest, with neither bulls nor bears gaining significant momentum during the session. Such price action typically suggests a period of consolidation as the market digests recent news and earnings data.

Trading Range and Market Parameters

The 52-week price range for Apple stock spans from $1.88 (169.21 rubles) to $2.89 (260.1 rubles), highlighting the stock's significant movement over the past year. Currently positioned within this range, AAPL exhibits potential for both upward momentum and downside risk depending on broader market conditions and company-specific developments.

Apple's market capitalization stands at approximately $35.06 billion (3155.34 billion rubles), confirming its status as one of the world's most valuable companies. This substantial market cap provides certain stability advantages but also creates challenges for generating percentage growth comparable to smaller, more nimble competitors.

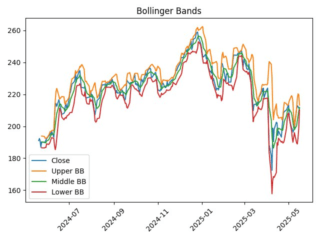

Technical Analysis Deep Dive

Moving Averages and Price Trends

Technical analysis offers crucial insights into Apple's stock momentum and potential directional movements. Key moving averages provide context for current price action:

SMA 50: $2.32 (208.47 rubles)

SMA 200: $2.52 (226.48 rubles)

EMA 20: $2.29 (206.51 rubles)

EMA 50: $2.34 (210.69 rubles)

The current price positioning above the 50-day simple moving average (SMA) indicates short-term bullish sentiment. However, trading below the 200-day SMA suggests longer-term caution may be warranted. The price's relationship to these key technical levels creates important decision points for traders monitoring support and resistance zones.

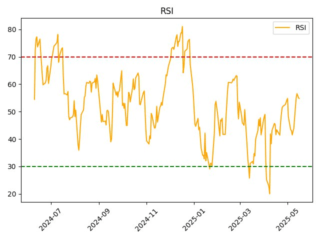

Momentum Indicators Assessment

Beyond simple price analysis, momentum indicators provide deeper insights into AAPL's trading dynamics:

RSI Analysis

The Relative Strength Index (RSI) currently reads 54.79, indicating a neutral market condition. This middle-range reading suggests neither overbought nor oversold conditions prevail, leaving room for price movement in either direction based on forthcoming catalysts.

Trend Strength Evaluation

The Average Directional Index (ADX) reading of 14.22 characterizes the current trend strength. This relatively low value indicates a weak trend, suggesting that the market may be entering a period of consolidation rather than exhibiting strong directional momentum.

Volume Confirmation

On-Balance Volume (OBV) stands at 1,130,820,774, supporting the current price trend. This volume indicator helps confirm price movements by analyzing whether volume is flowing in or out of the security, adding credibility to the observed trend.

Advanced Technical Indicators

Parabolic SAR Implications

The Parabolic Stop and Reverse (SAR) indicator shows a value of $2.19 (196.73 rubles), potentially signaling a trend reversal. This indicator is particularly useful for traders seeking to identify potential exit and entry points during trend changes. The current positioning below the price suggests a bullish interpretation.

Volatility Measurements

Average True Range (ATR) stands at $0.074 (6.64 rubles), reflecting current market volatility. This measurement helps traders set appropriate stop-loss levels and position sizing based on expected price fluctuations. The moderate ATR value indicates balanced volatility conditions.

Commodity Channel Index Perspective

The Commodity Channel Index (CCI) reading of 69.8 approaches overbought territory, potentially signaling caution for new long positions. While not yet at extreme levels that would indicate immediate reversal risk, this elevated reading suggests monitoring for potential consolidation or pullback.

Fundamental Analysis Highlights

Strong fundamental metrics complement technical analysis for comprehensive investment decisions. Apple's current fundamentals present a mixed picture:

Profitability Metrics

Return on Equity (ROE): 138.02%

Return on Assets (ROA): 23.81%

These exceptional return metrics demonstrate Apple's efficient use of shareholder equity and company assets to generate profits, significantly outperforming industry averages.

Valuation Parameters

Price-to-Earnings Ratio (P/E): 32.91

The current P/E ratio suggests premium valuation compared to historical averages, potentially indicating investor optimism about future growth prospects or a stretched valuation requiring careful consideration.

Financial Health Indicators

Debt-to-Equity Ratio: 146.99

Net Debt/EBITDA: 0.0

Apple's debt structure reflects strategic financial management, with reasonable leverage that balances growth funding with financial stability. The zero net debt to EBITDA suggests strong cash reserves offsetting outstanding debt obligations.

Dividend Analysis and Income Potential

Current Dividend Structure

Apple offers a dividend of $0.0029 (0.26 rubles) per share, representing a yield of 0.13%. While this yield appears modest compared to traditional dividend stocks, it complements Apple's growth profile with income generation potential.

Important Dividend Dates

Ex-Dividend Date: May 11, 2025

Payment Date: May 15, 2025

Investors seeking to qualify for the upcoming dividend must purchase shares before the ex-dividend date, with payments distributed shortly thereafter. This regular dividend schedule demonstrates Apple's commitment to shareholder returns alongside growth initiatives.

Candlestick Pattern Recognition

Current price action shows an absence of recognizable candlestick patterns, indicating neutral short-term technical signals. Candlestick patterns often provide early warning signs of potential reversals or continuation patterns through specific price formations. The lack of clear patterns suggests waiting for more definitive signals before making significant position changes.

Price Forecasting Models

Short-Term Price Projection

The projected price for the next trading day stands at $2.52 (226.81 rubles), suggesting potential upside from current levels. This forecast derives from algorithmic analysis incorporating technical indicators, historical patterns, and current market conditions.

Support and Resistance Levels

Key technical levels for active monitoring include:

Support Level 1: $2.32 (208.47 rubles)

Support Level 2: $2.34 (210.69 rubles)

These levels represent potential price floors where buying interest may emerge to stabilize declining prices. Traders often use these points for stop placement and entry consideration.

Investment Risk Assessment

Risk Evaluation Summary

Current analysis indicates elevated risk factors associated with Apple stock investments. These concerns stem from potential overvaluation, weak trend strength (14.22), and inconsistent return patterns. Prudent risk management suggests position sizing appropriate to this higher-risk profile.

Market Sentiment Analysis

Despite technical caution signals, overall market sentiment toward Apple remains cautiously optimistic. The company's innovation pipeline, strong ecosystem lock-in effects, and substantial cash reserves continue to generate investor confidence. This sentiment backdrop provides support during technical weakness.

Long-Term Investment Considerations

Growth Catalysts and Opportunities

Apple's long-term investment case remains compelling despite short-term fluctuations. Key growth drivers include:

Expansion into emerging markets

Services revenue growth

Product ecosystem development

Potential new category introductions

These structural advantages position Apple well for sustained long-term performance, even amid periodic volatility episodes.

Competitive Position Assessment

Apple maintains dominant competitive positioning through:

Brand strength and loyalty

Vertical integration of hardware and software

Growing services ecosystem

Premium pricing power

These advantages create substantial moats against competitive threats, supporting long-term value creation potential.

Portfolio Integration Strategies

Portfolio Allocation Recommendations

When considering Apple stock within a diversified portfolio, investors should:

Align position sizing with personal risk tolerance

Consider dollar-cost averaging during periods of volatility

Evaluate sector concentration risk

Balance growth potential with dividend income

These strategic considerations help optimize Apple's role within broader investment objectives.

Conclusion: Investment Outlook Summary

The comprehensive analysis of Apple stock (AAPL) suggests a cautiously optimistic outlook with notable technical considerations. With current volatility measured at $0.074 (6.64 rubles) and trend strength at 14.22, the market presents opportunities for disciplined investors willing to navigate short-term fluctuations.

The forecast remains positive despite certain technical caution signals. Particular attention should focus on the support levels at $2.32 (208.47 rubles) and $2.34 (210.69 rubles), which represent potential entry points for those seeking to establish or add to positions. These technical levels provide context for timing decisions within broader strategic allocation plans.

Predicted price

Historical return calculator

Income for the selected period

Total: +$1,037.26+6.81%

Calculation based on the dynamics of the share price for the period from 21.09.2025 to 21.10.2025

read other forecasts

No comments yet

Be the first to share your thoughts on this