Oracle (ORCL) Stock Forecast – Predictions & Technical Analysis 21.10.2025

Oracle stock forecast for October 2025

Current Market Position of Oracle Stock

Oracle shares are currently trading at $1.75, showing moderately positive momentum that surpasses key support levels. This positioning suggests a resilient performance amid broader market fluctuations, potentially offering both stability and growth opportunities for investors seeking technology exposure.

The current trading session began at $1.74, reaching a high of $1.75 and a low of $1.73. This relatively tight trading range indicates investor confidence while demonstrating sufficient liquidity and market interest in the stock.

Market Capitalization and Trading Range

With a market capitalization of approximately $4.90 billion, Oracle maintains its position as a significant player in the enterprise software landscape. The company's 52-week trading range spans from $1.25 to $2.16, highlighting considerable price movement over the past year and offering strategic entry points for varying investment approaches.

Dividend Performance

Oracle currently offers:

Dividend per share: $0.0054

Dividend yield: 0.36%

Ex-dividend date: April 9, 2025

Payment date: April 23, 2025

While the dividend yield remains modest compared to traditional dividend stocks, Oracle's consistent payment schedule provides a supplementary income stream alongside potential capital appreciation.

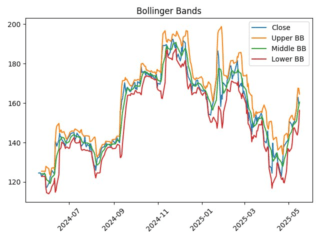

Technical Analysis Deep Dive

Technical indicators offer valuable insights into Oracle's price momentum and potential future movements. A comprehensive examination reveals several noteworthy patterns and signals worth monitoring.

Moving Averages Assessment

Moving averages serve as critical reference points for understanding Oracle's price trends:

Simple Moving Average (SMA) 50: $1.57

Simple Moving Average (SMA) 200: $1.75

Exponential Moving Average (EMA) 20: $1.63

Exponential Moving Average (EMA) 50: $1.62

The current price positioning above both the 50-day SMA and the short-term EMAs signals positive momentum. However, the proximity to the 200-day SMA warrants attention, as this level could act as either resistance or support depending on price action in upcoming sessions.

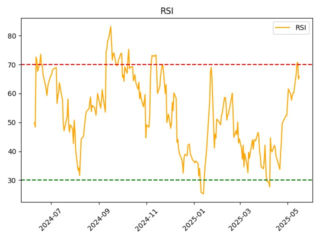

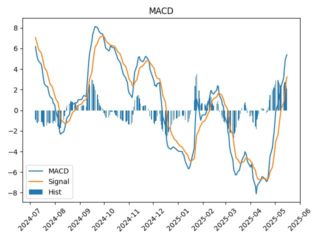

Momentum Indicators

Several momentum indicators provide additional context for Oracle's current trading pattern:

Relative Strength Index (RSI): 65.86 – indicating neutral conditions with room for continued upward movement before reaching overbought territory

Commodity Channel Index (CCI) (20): 101.28 – suggesting positive momentum

Average Directional Index (ADX) (14): 21.09 – reflecting moderate trend strength

On-Balance Volume (OBV): 172,443,976 – confirming the underlying trend with volume support

Volatility Measurements

Understanding Oracle's volatility components helps contextualize risk expectations:

Average True Range (ATR): $0.053 – signaling moderate price uncertainty

Parabolic SAR: $1.69 – indicating a potential trend reversal point to monitor

Candlestick Patterns

Recent price action has revealed a Harami candlestick pattern, which frequently suggests a potential reversal in market sentiment. This pattern merits close observation, particularly when aligned with other technical indicators.

Fundamental Analysis Overview

While technical indicators provide timing insights, fundamental metrics offer perspective on Oracle's underlying business strength and valuation considerations.

Valuation Metrics

Oracle's current valuation metrics present a mixed picture:

Price-to-Earnings (P/E) Ratio: 37.76

Earnings Per Share (EPS): Not currently available in the provided data

Return on Equity (ROE): 103.74%

Return on Assets (ROA): 7.35%

The elevated P/E ratio suggests investors are pricing in strong growth expectations, while the impressive ROE indicates efficient use of shareholder equity. The solid ROA demonstrates effective asset utilization compared to industry peers.

Debt Structure Analysis

Oracle's debt profile requires careful consideration:

Debt-to-Equity Ratio: 632.5

Net Debt-to-EBITDA: Not currently available in the provided data

Free Cash Flow (FCF): Not currently available in the provided data

The high debt-to-equity ratio highlights Oracle's leveraged capital structure, which could represent either strategic financial management or potential risk depending on interest rate trends and operational performance.

Investment Outlook and Price Projections

Short-Term Price Forecast

Based on the convergence of technical indicators and recent price action, Oracle's projected price for the upcoming trading session stands at approximately $1.81. This forecast represents a potential upside from current levels, contingent upon market conditions and broader index movements.

Risk Assessment Framework

Several key risk factors and support levels deserve attention:

Primary support levels established at $1.57 (50-day SMA)

Secondary support emerging at $1.62 (50-day EMA)

Initial resistance at $1.75 (200-day SMA)

Secondary resistance potentially forming near previous 52-week highs around $2.16

Investment Sentiment Evaluation

The current technical and fundamental landscape suggests a neutral-to-positive outlook for Oracle shares. While some parameters appear attractive, certain risk elements necessitate prudent position sizing and strategic entry planning.

Oracle's Market Position in the Enterprise Software Landscape

Competitive Positioning

Oracle continues to navigate an increasingly competitive enterprise software environment, facing pressure from both established players and cloud-native challengers. The company's extensive product portfolio and enterprise relationships provide defensive advantages, though innovation pace remains crucial for maintaining market relevance.

Cloud Transition Progress

Oracle's ongoing cloud transformation represents a pivotal strategic initiative that could significantly impact future financial performance. As enterprises increasingly migrate to cloud-based solutions, Oracle's success in capturing this shift will likely determine long-term shareholder returns.

Key Levels to Monitor for Oracle Investors

Successful Oracle investing requires vigilant attention to several critical price levels:

$1.57 (50-day SMA): Represents a psychological support level that could trigger technical buying interest if tested

$1.62 (50-day EMA): Offers a dynamic support zone that frequently attracts institutional attention

$1.75 (200-day SMA): Serves as both a resistance level and potential confirmation point for longer-term trend direction

$1.69 (Parabolic SAR): Indicates a potential trend reversal point that could signal changing momentum

Volatility Considerations for Position Sizing

With an ATR of $0.053 and trend strength of 21.09, Oracle presents a moderate volatility profile. This measurement suggests appropriate position sizing should account for potential price swings while allowing for reasonable stop-loss placement without premature triggering.

Long-Term Investment Considerations

Growth Catalysts

Several potential growth catalysts could influence Oracle's long-term trajectory:

Continued cloud services expansion

Database market leadership maintenance

Enterprise application suite adoption

Potential strategic acquisitions

Artificial intelligence and machine learning integration

Risk Factors

Balanced analysis requires acknowledgment of potential headwinds:

Intensifying competitive pressures

Cloud transition execution challenges

Regulatory considerations in global markets

Macroeconomic sensitivity

Technological disruption risks

Trading Strategies for Different Investor Profiles

Conservative Approach

Investors with lower risk tolerance might consider:

Initiating partial positions at current levels

Adding on pullbacks toward the 50-day SMA ($1.57)

Implementing covered call strategies to enhance yield

Setting stop-loss orders below major support levels

Growth-Oriented Approach

More aggressive investors could explore:

Full position establishment at current levels

Leveraging options strategies to enhance potential returns

Focusing on technical breakout confirmation above the 200-day SMA

Implementing trailing stops to protect profits while allowing for upside participation

Technical Indicator Convergence Analysis

The current technical setup demonstrates several noteworthy indicator interactions:

Price positioning above key moving averages suggests positive momentum

Neutral RSI reading provides room for continued upward movement

Positive CCI reading confirms short-term bullish sentiment

OBV trend alignment validates price action with volume confirmation

This convergence pattern typically precedes continued trend development, though confirmation through sustained trading above resistance levels remains essential.

Conclusion: Oracle's Investment Potential

Oracle stock presents a moderately positive outlook based on current technical indicators and fundamental positioning. With shares trading above key support levels and demonstrating positive momentum indicators, the near-term projection suggests potential upside toward $1.81.

For investors considering Oracle exposure, the current entry point offers a balanced risk-reward profile, though prudent position sizing remains essential given the stock's moderate volatility profile. Particular attention should be directed toward the critical technical levels at $1.57 and $1.62, which represent important reference points for trend confirmation or potential reversal signals.

Predicted price

Historical return calculator

Income for the selected period

Total: -$1,558.69-10.27%

Calculation based on the dynamics of the share price for the period from 21.09.2025 to 21.10.2025

read other forecasts

No comments yet

Be the first to share your thoughts on this