Qualcomm (QCOM) Stock Forecast – Predictions & Technical Analysis 21.10.2025

Qualcomm stock forecast for October 2025

Current Market Position of Qualcomm Stock

Qualcomm is currently showing moderately positive momentum in the market. The stock is trading at approximately $1.67 per share, positioning it above several key moving averages. Today's trading session opened at $1.68, reaching a high of $1.68 and a low of $1.66, indicating investor readiness to establish new positions despite market fluctuations.

Recent Price Action and Market Sentiment

The current price point reflects a balanced market sentiment toward Qualcomm's growth potential. With the stock hovering above critical support levels, investors appear cautiously optimistic about the company's trajectory in the semiconductor industry. This positioning is particularly noteworthy given the competitive landscape and ongoing global supply chain considerations affecting tech manufacturers.

Technical Analysis: Understanding Qualcomm's Stock Momentum

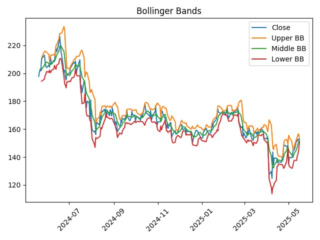

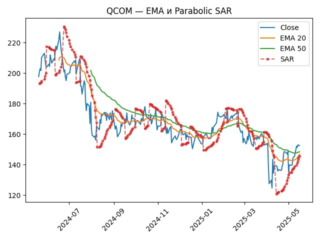

Moving Averages Breakdown

Moving averages provide essential insights into Qualcomm's price trend and potential reversal points:

Simple Moving Average (SMA) 50: $1.62

Simple Moving Average (SMA) 200: $1.77

Exponential Moving Average (EMA) 20: $1.61

Exponential Moving Average (EMA) 50: $1.63

The current price positioning above the 50-day SMA and 20-day EMA suggests a positive short-term outlook, while remaining below the 200-day SMA indicates potential resistance at higher levels.

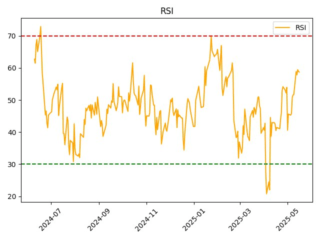

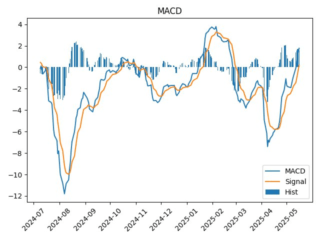

Key Technical Indicators

Trend and Momentum Indicators

Parabolic SAR: $1.60 - Currently confirming the prevailing trend

Relative Strength Index (RSI): 58.73 - Indicating a neutral condition with room for growth

Average True Range (ATR): $0.055 - Highlighting market uncertainty

Advanced Technical Signals

Commodity Channel Index (CCI-20): 103.71 - Potentially signaling overbought conditions

Average Directional Index (ADX-14): 16.96 - Characterizing trend strength

On-Balance Volume (OBV): -117,159,285 - Reflecting volume behavior relative to price movement

This combination of indicators suggests Qualcomm stock is in a consolidation phase with moderate upward potential, though investors should monitor for possible overbought conditions in the short term.

Fundamental Analysis: Qualcomm's Financial Health

Key Financial Metrics

Understanding Qualcomm's fundamental indicators provides critical context for investment decisions:

Earnings Per Share (EPS): $0.0

Price-to-Earnings Ratio (P/E): 15.55

Return on Equity (ROE): 42.21%

Return on Assets (ROA): 13.43%

Debt-to-Equity Ratio: 52.74

Net Debt/EBITDA: 0.0

Free Cash Flow (FCF): $0.0 billion

The company's market capitalization stands at approximately $1.84 billion, reflecting its substantial presence in the semiconductor industry.

Dividend Performance and Shareholder Value

For income-focused investors, Qualcomm offers:

Dividend per Share: $0.0098

Dividend Yield: 0.59%

Ex-Dividend Date: June 4, 2025

Payment Date: June 26, 2025

While the dividend yield remains modest compared to some income stocks, Qualcomm's consistent payment schedule offers a supplementary benefit to its growth potential.

Market Context and Trading Range

The 52-week trading range for Qualcomm spans from $1.33 to $2.54, demonstrating significant volatility throughout the year. The current price sits closer to the middle of this range, suggesting balanced market sentiment and potential room for movement in either direction depending on forthcoming market developments and company announcements.

Candlestick Pattern Analysis

Analysis of recent price action reveals no significant candlestick patterns at present. This absence of clear formation signals suggests a period of market indecision that may precede a more definitive movement.

Short-Term Price Projections for Qualcomm

The forecasted price for Qualcomm in the next trading day is approximately $1.55, representing a slight decrease from current levels. This projection incorporates technical indicators, market sentiment, and recent price action.

Risk Assessment and Investment Appeal

Current market indicators suggest:

❤️ High Risk Assessment - Potentially overvalued conditions, weak trend characteristics, or unstable yield patterns.

Investors should pay particular attention to the $1.62 and $1.63 levels as potential reversal zones that could significantly impact short-term trading strategies.

Qualcomm's Position in the Semiconductor Industry

Competitive Landscape Analysis

Qualcomm continues to navigate a competitive landscape dominated by major semiconductor players and emerging specialized chip manufacturers. The company's strong intellectual property portfolio in wireless technology provides a competitive advantage, particularly as 5G deployment accelerates globally.

Market Segment Performance

Qualcomm's diversification across mobile processors, automotive solutions, and Internet of Things (IoT) applications positions the company to capitalize on multiple growth vectors. Recent developments in each segment influence investor perception and long-term growth potential:

Mobile Technology Leadership

Qualcomm's Snapdragon processors remain industry benchmarks for mobile device performance. The continued innovation in this core business segment provides stable revenue streams while allowing for expansion into adjacent markets.

Automotive Innovation Pipeline

As vehicles become increasingly connected and automated, Qualcomm's expanding automotive product portfolio represents a significant growth opportunity. Recent partnerships with major automakers strengthen the company's position in this rapidly evolving market segment.

IoT and Extended Reality Development

The company's strategic investments in IoT and extended reality technologies address emerging high-growth markets. Progress in these areas represents potential future revenue streams that could significantly impact long-term valuation.

Qualcomm's Strategic Initiatives and Future Outlook

Research and Development Focus

Qualcomm's continued investment in R&D across key technology areas signals commitment to maintaining technological leadership. Recent patent acquisitions and innovation announcements demonstrate the company's forward-looking approach to market development.

Supply Chain Resilience

In response to global semiconductor supply challenges, Qualcomm has implemented strategic initiatives to enhance production capacity and supply chain resilience. These efforts may provide competitive advantages as the industry continues to face manufacturing constraints.

Regulatory Considerations

Ongoing regulatory developments in key markets, including antitrust considerations and export controls, represent potential challenges for Qualcomm's global operations. Investors should monitor these developments for potential impacts on growth strategies and market access.

Technical Trading Strategies for Qualcomm Stock

Support and Resistance Levels

Current technical analysis identifies several key price levels that may influence trading decisions:

Major Support: $1.60 (Parabolic SAR)

Secondary Support: $1.62 (50-day SMA)

Key Resistance: $1.77 (200-day SMA)

Secondary Resistance: $1.70 (psychological level)

Volume Profile Analysis

Recent trading volume patterns suggest moderate conviction behind price movements. The negative OBV reading indicates potential divergence between price action and underlying buying pressure, warranting careful monitoring by technical traders.

Volatility Considerations

With an ATR of $0.055 and ADX of 16.96, Qualcomm currently presents moderate volatility and trend strength. These metrics suggest favorable conditions for range-bound trading strategies while maintaining appropriate risk management protocols.

Investment Considerations and Risk Factors

Short-Term Investment Potential

The current market analysis suggests Qualcomm may present opportunities for short-term investment strategies, particularly given the current volatility levels and moderate trend strength. However, investors should proceed with caution, implementing appropriate position sizing and stop-loss strategies.

Long-Term Growth Prospects

Despite short-term fluctuations, Qualcomm's fundamental positioning in critical technology growth sectors supports a generally positive long-term outlook. The company's established market presence, intellectual property assets, and strategic diversification provide a foundation for sustained competitiveness.

Risk Mitigation Strategies

Given the current risk assessment, investors might consider:

Phased Entry Approaches: Establishing positions gradually rather than with single large investments

Options Strategies: Using options to define risk parameters more precisely

Portfolio Integration: Balancing Qualcomm exposure with complementary technology investments

Conclusion: Qualcomm's Market Outlook and Investor Implications

The overall forecast for Qualcomm remains moderately optimistic, with technical indicators suggesting continued trend development. The stock presents particular interest for short-term investment strategies given the current volatility of $0.055 and trend strength of 16.96.

Investors should maintain vigilant monitoring of key price levels, particularly the $1.62 and $1.63 zones, which represent potential reversal points that could significantly impact trading outcomes. Additionally, upcoming earnings announcements, industry developments, and broader market sentiment will play crucial roles in determining Qualcomm's price trajectory.

Predicted price

Historical return calculator

Income for the selected period

Total: +$0.90+0.01%

Calculation based on the dynamics of the share price for the period from 21.09.2025 to 21.10.2025

read other forecasts

No comments yet

Be the first to share your thoughts on this